TAX - VAT Merging: 2nd SDDP: Difference between revisions

No edit summary |

No edit summary |

||

| Line 4: | Line 4: | ||

|report_title= [[SDDP TAX - VAT Merging]] <!-- if a variable left empty e.g " report_title =" or not used at all then it will not appear on the template --> | |report_title= [[SDDP TAX - VAT Merging]] <!-- if a variable left empty e.g " report_title =" or not used at all then it will not appear on the template --> | ||

|LeadFacilitator=[[Marios Michaelides]] <br> [[Yiannis Laouris]] | |LeadFacilitator=[[Marios Michaelides]] <br> [[Yiannis Laouris]] | ||

|AsFacilitator= | |||

|Triggering_Question= "What are the expectations from the merging of the Inland Revenue Department and Value Added Tax (VAT) in a single organization?" | |Triggering_Question= "What are the expectations from the merging of the Inland Revenue Department and Value Added Tax (VAT) in a single organization?" | ||

|project=[[Merging of TAX - VAT Units in Cyprus]] | |project=[[Merging of TAX - VAT Units in Cyprus]] | ||

Revision as of 05:18, 29 January 2019

|

Executive Summary

During the period 7-19 November, the project team , in collaboration with the Cyprus Academy of Public Administration (CAPA), conducted three consultation meetings - workshops with all interested stakeholders in-order to analyse the smooth transition of merging the IRD and VAT Services. For the second co-laboratory twelve representatives from business, auditing, legal and other business associations and bodies participated in an SDDP, which took place 14-15 of November (total 12 hours) at the CAPA premises, with primary target to define their Expectations from the new system.

The Triggering Question (TQ) of the second workshop was:

"What are the expectations from the merging of the Inland Revenue Department and Value Added Tax (VAT) in a single organization?"

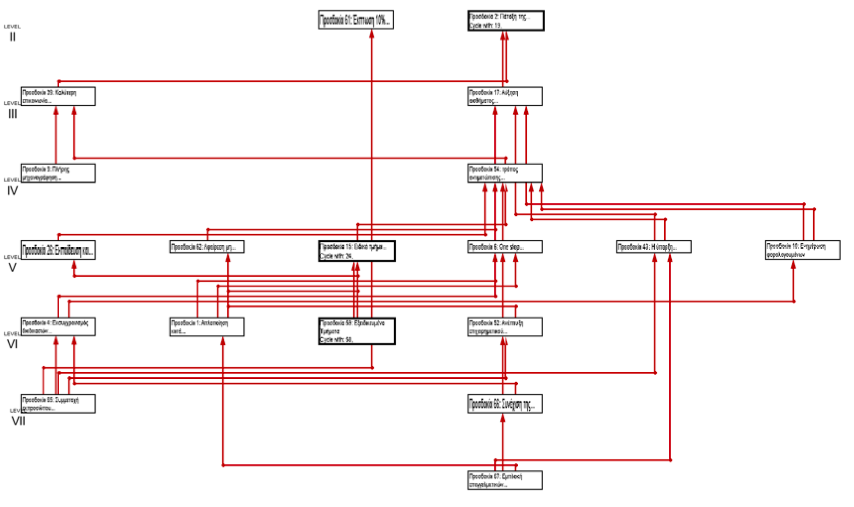

In response to the TQ, the 12 participants came up with 67 challenges, which were categorized in 11 clusters. Following the voting process, 50 ideas received one or more votes and were structured to create the influence MAP shown below.

According to the participants of this workshop, the expectations that appeared to be the most influential were:

- Expectation #65 Participation of business representatives in decision-making

- Expectation #66 Continuation of the practice of regular contacts between professional bodies and tax authorities for practical application of the legislation

- Expectation #67 Engagement of professional associations of accountants in the planning and the determination of the tax policy

- Expectation #1 Simplification of the procedures and regulations during the consolidation

- Expectation #4 Procedures modernization and transparency

- Expectation #58 Placement of specialized trained officers in dealing with items of their specialization

- Expectation #59 Specialized Departments

The workshop was mainly facilitated by Marios Michaelides and Yiannis Laouris.

In sum, the way expectations are structured on the influence tree shows that the majority of the participants expect that the unification of the two tax departments will finally combat tax evasion and increase tax collection capacity. In order to achieve those two expectations, the new organization should undertake a series of actions that the participants consider important and useful:

1. Extraversion with the configuration of communication channels, collaboration and involvement of the business community in planning and decision making 2. Orderly Operation with the simplification and modernization of procedures and transparency 3. Internal Organization and Personnel Issues

The co-laboratory showed that the external partners consider their involvement in decision making, designing and setting the taxation policy crucial.